Ever since the COVID-19 pandemic it seems people are hearing about the term “inflation” more than ever. The COVID-19 pandemic, which swept across the globe with unprecedented speed and severity, not only upended public health and daily life but also had profound and far-reaching implications for the world’s economies. As nations implemented extensive lockdowns and travel restrictions to mitigate the spread of the virus, the resulting economic fallout was immediate and substantial. In response to the crisis, governments and central banks worldwide adopted a range of fiscal and monetary policies, including massive stimulus packages and historically low interest rates, to stabilize their economies. As we emerged from the depths of the pandemic, the trajectory of inflation became a focal point of discussion and concern.

What is Inflation?

Inflation is the sustained increase in the general price level of goods and services in an economy over a period of time. It is often expressed as an annual percentage, and it indicates a decrease in the purchasing power of a currency. Inflation occurs when the demand for goods and services exceeds their supply, leading to rising prices. Several factors can contribute to inflation, including:

- Demand-Pull Inflation: This type of inflation occurs when there is an increase in demand for goods and services that outpaces their supply. Consumers and businesses are willing to pay more, causing prices to rise.

- Cost-Push Inflation: This happens when the cost of production for goods and services increases. This can be due to factors like rising wages, increased raw material costs, or disruptions in the supply chain.

- Built-In Inflation: Sometimes, inflation can become self-perpetuating. When people expect prices to rise, they demand higher wages, and businesses raise prices to cover increased labor costs. This cycle can lead to sustained inflation.

- Monetary Policy: Central banks, like the Federal Reserve in the United States or the Bank of Canada, can influence inflation through their control of the money supply. By increasing or decreasing interest rates, they can encourage or discourage borrowing and spending, affecting inflation.

Inflation can have both positive and negative effects. Mild inflation is generally considered normal in a growing economy and can encourage spending and investment. However, high or hyperinflation can erode the value of money, disrupt economic stability, and lead to uncertainty in financial markets. Central banks typically aim to maintain a target inflation rate to strike a balance between these potential benefits and drawbacks.

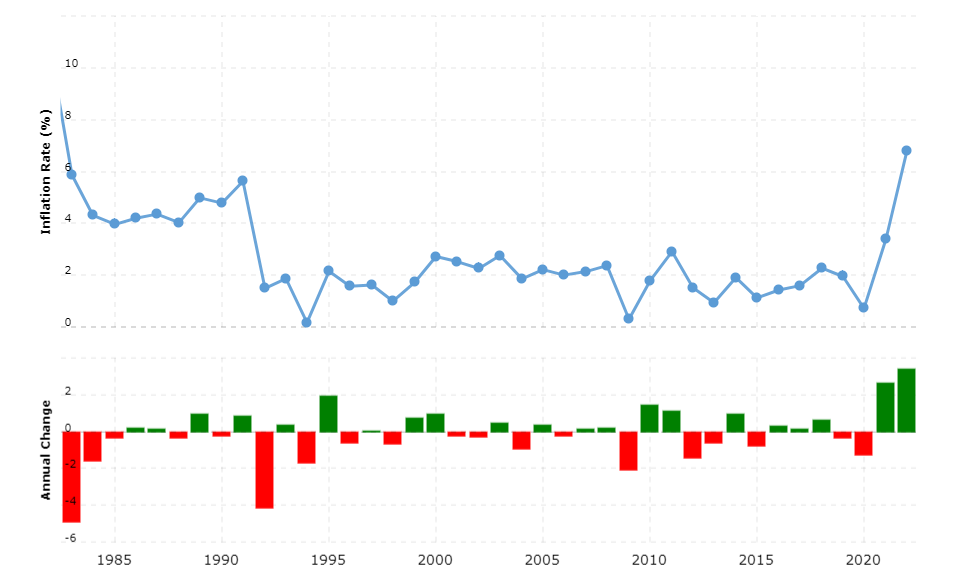

Canada’s Historic Inflation Rates

Source: World Bank

The Negative Impacts of High Inflation

- Erosion of Purchasing Power: High inflation is like a silent thief that stealthily erodes the purchasing power of money. As prices of everyday goods and services increase, your hard-earned dollars can buy less and less. What cost you $100 last year may now require $110, $120, or more. This means that your savings and income may no longer stretch as far as they used to, leading to a decreased standard of living.

- Uncertainty and Planning Challenges: A persistently high inflation rate can create uncertainty in the economy. Businesses may find it challenging to set prices and budget for the future, as they must anticipate how much their costs will rise. Individuals face similar issues, making it difficult to plan for big expenses like buying a home, sending children to college, or saving for retirement. This economic instability can disrupt long-term financial planning.

- Fixed-Income Vulnerability: Individuals on fixed incomes, such as retirees living off pensions or fixed annuities, are particularly vulnerable to high inflation. Their income remains constant, but the cost of living keeps rising. This can force them to make sacrifices, cut expenses, and potentially dip into savings, making their financial future even more uncertain.

- Reduced Real Returns on Investments: High inflation can diminish the real returns on investments. If the returns on your investments are lower than the inflation rate, your investment’s real value decreases. Investors may need to take on higher levels of risk to seek returns that outpace inflation, potentially exposing themselves to more significant financial risk.

- Interest Rate Conundrum: Central banks often raise interest rates to combat high inflation. While this can help control price increases, it also means that borrowing becomes more expensive. Mortgages, loans, and credit card debt become costlier, placing a burden on households and potentially discouraging investments in businesses.

- Income Inequality: High inflation can exacerbate income inequality. Those with the means to invest in assets that tend to rise with inflation, like stocks or real estate, may see their wealth grow. However, those who primarily rely on wages and salaries, especially low-income individuals, may find it difficult to keep pace with rising living costs, further widening the wealth gap.

How to Combat High Inflation

Combatting high inflation rates is a complex task that typically falls under the purview of the central bank and the government. However, individuals and households can take several steps to mitigate the impact of high inflation on their personal finances. Here are some strategies for Canadians to consider:

- Invest Wisely: Consider investing in assets that tend to perform well during periods of inflation, such as stocks, real estate, and commodities. These investments have historically provided a hedge against rising prices.

- Diversify Your Portfolio: Diversification can help reduce risk. Spread your investments across different asset classes and geographic regions to minimize the impact of inflation on your overall wealth.

- TIPS and Inflation-Protected Securities: In some countries, including the United States, there are government-issued securities like Treasury Inflation-Protected Securities (TIPS) that offer a guaranteed return above the rate of inflation. Check if Canada offers similar inflation-protected investment options.

- Review Your Savings and Investments: Regularly review your savings and investment accounts to ensure they are keeping pace with or outpacing inflation. Make adjustments as necessary.

- Increase Your Income: Consider strategies to increase your income, such as seeking better-paying job opportunities, starting a side business, or investing in your education and skills.

- Budget and Save: Stick to a budget to control your spending and increase your savings. The more you can save and invest, the better you can protect your wealth from inflation’s erosion.

- Consider Fixed-Rate Debts: High inflation can erode the real value of debt. If you have fixed-rate debts, the real cost of repaying them decreases over time as the value of money drops.

- Use Inflation-Indexed Products: Some financial institutions offer products like inflation-indexed savings accounts or certificates of deposit (CDs). These can provide some protection against inflation.

- Stay Informed: Keep yourself informed about economic developments and central bank policies. Understanding the economic environment can help you make informed financial decisions.

- Consult a Financial Advisor: If you have significant assets or complex financial needs, consider consulting a financial advisor who can provide tailored advice for your specific situation.

It’s important to note that while these strategies can help individuals manage the impact of high inflation, they may not eliminate all the challenges associated with rising prices. The broader management of inflation is the responsibility of central banks and governments through monetary and fiscal policies.

The Bottom Line

The importance of hedging against inflation to protect your finances cannot be overstated. Inflation, as a persistent rise in the general price level of goods and services, can erode the real value of money and, over time, significantly diminish one’s purchasing power. By implementing sound financial strategies, such as diversifying investments, holding inflation-protected assets, and budgeting prudently, individuals can shield themselves from the adverse effects of inflation. In doing so, they not only safeguard their wealth but also ensure their long-term financial security and the ability to achieve their financial goals. As history has shown, the value of careful financial planning in the face of inflation is immeasurable, providing a means to thrive and grow even in the most challenging economic environments.