In an increasingly complex financial landscape, managing your wealth efficiently and effectively is of paramount importance. Enter Wealthsimple, a fintech company that has been making waves in the world of personal finance. With its user-friendly platform and innovative approach to investing, Wealthsimple offers a range of benefits that can help individuals, both seasoned investors and newcomers alike, achieve their financial goals. In this article, we’ll delve into the advantages of using Wealthsimple as your financial ally.

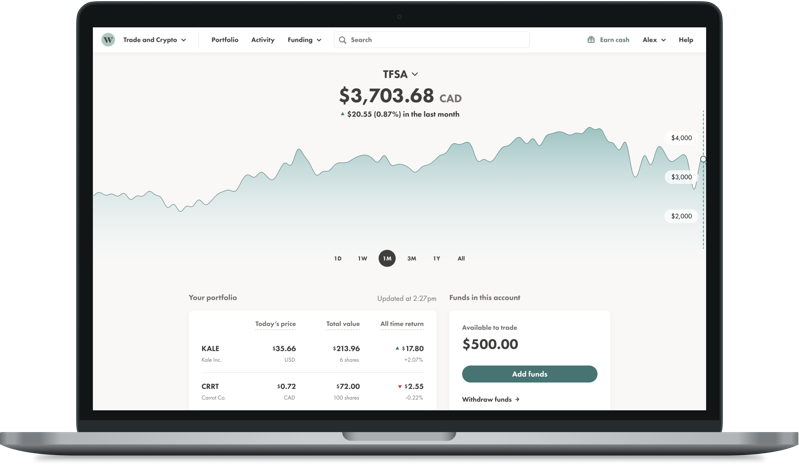

- Accessible and User-Friendly Platform: One of Wealthsimple’s standout features is its intuitive and user-friendly platform. Whether you’re a novice investor or a seasoned pro, the platform is designed to make investing accessible to all. Its clean interface, straightforward navigation, and educational resources ensure that you can start investing with confidence, even if you’re new to the game.

- Robo-Advisors for Hands-Off Investing: Wealthsimple offers a robo-advisor service that takes the guesswork out of investing. By assessing your financial goals, risk tolerance, and time horizon, Wealthsimple’s algorithms create a personalized investment portfolio for you. This automated approach allows you to invest with minimal effort, as the platform handles portfolio rebalancing and adjustments on your behalf.

- Diverse Investment Options: Wealthsimple provides a range of investment options, including ETFs (Exchange-Traded Funds), socially responsible investing portfolios, and halal investing portfolios. This diversity allows you to tailor your investments to align with your values and financial objectives.

- Low Fees and Transparent Pricing: One of the primary benefits of using Wealthsimple is its competitive fee structure. The platform charges lower management fees compared to many traditional financial institutions, allowing you to keep more of your returns. Moreover, Wealthsimple is upfront about its fees, ensuring transparency in your investment costs.

- Financial Planning Tools: Wealthsimple offers financial planning tools to help you set and track your financial goals. You can use these tools to create savings plans, retirement goals, and other financial objectives. This feature empowers you to take control of your financial future and make informed decisions.

- Tax-Efficient Investing: Wealthsimple’s platform includes tax-efficient investing strategies, such as tax-loss harvesting, which can help you minimize your tax liabilities and maximize your after-tax returns.

- Automatic Roundup and Saving Features: Wealthsimple’s innovative features like “Roundup” automatically invest your spare change from everyday transactions, helping you save and invest effortlessly. This small change can add up over time and contribute significantly to your financial goals.

- Mobile Accessibility: The Wealthsimple app ensures that you can manage your investments on the go. The mobile app offers all the features of the desktop platform, allowing you to stay connected to your finances wherever you are.

Wealthsimple offers plenty of benefits that can help you navigate the complexities of wealth management and investing. Its user-friendly platform, robo-advisor services, diverse investment options, low fees, and financial planning tools make it an attractive choice for individuals seeking to grow their wealth efficiently and sustainably. Whether you’re saving for retirement, investing for your children’s education, or pursuing other financial goals, Wealthsimple provides the tools and resources to help you achieve financial success. Consider exploring what Wealthsimple has to offer and take a step toward securing your financial future today.

Join Wealthsimple and get up to $3,000 in FREE Stock -> HERE <-