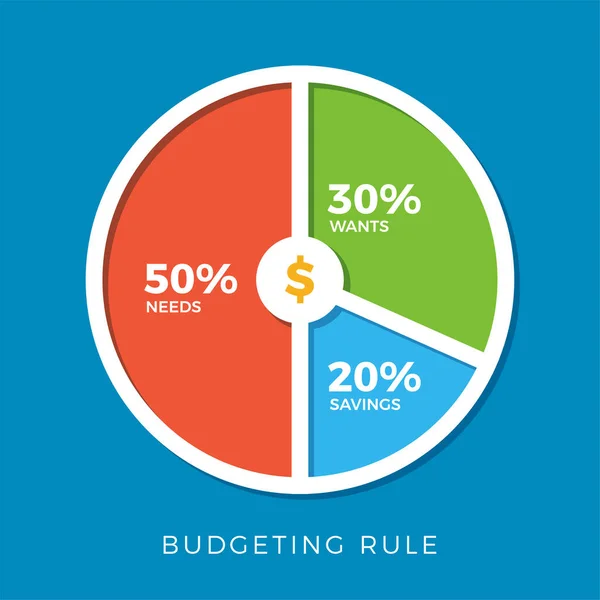

In today’s uncertain times, financial security is more important than ever. However, balancing your income between spending, saving, and investing can often feel like a daunting task. Fortunately, the 50/30/20 rule provides a practical framework to manage your finances and create financial freedom. In this blog post, we will explain how the 50/30/20 rule can help you achieve long-term financial stability and independence.

The 50/30/20 rule is a budgeting guideline that recommends distributing your income into three distinct categories. Here’s how it all breaks down:

What is the 50/30/20 Rule?

Essential Expenses (50%):

The first category represents your essential expenses, accounting for 50% of your monthly net income. These are non-negotiable expenses that you must pay each month, such as rent or mortgage payments, utilities, transportation, and groceries. These expenses are essential for day-to-day living, and it’s crucial to calculate them accurately to avoid overspending.

Discretionary Spending (30%):

The second category corresponds to discretionary spending or wants. This makes up 30% of your monthly net income and includes spending on non-essential items like entertainment, vacations, hobbies, and dining out. While it’s essential to indulge in life’s pleasures, it’s vital to practice moderation to ensure that your spending aligns with your long-term financial goals.

Savings and Investments (20%):

The third and final category accounts for 20% of your monthly net income and emphasizes building financial security and independence. This category includes savings for emergencies, retirement accounts, and investing in stocks and bonds. This portion of your income ensures that you have a solid financial foundation by the time you retire and that you avoid financial challenges from unexpected expenses.

How to Implement the 50/30/20 Rule and Create Financial Freedom

Implementing the 50/30/20 rule is an excellent starting point for financial success. Here is how you can use it to create financial freedom:

Start with a Budget:

Before you distribute your income using the 50/30/20 rule, create a budget that outlines your monthly obligations and discretionary spending. Write down your monthly income and then list every expense you have. Include everything, from your rent or mortgage payments to gas and electric bills, groceries, and entertainment. When creating your budget, be mindful of your cash flow and determine what you can contribute each month towards saving and investing.

Prioritize Essential Expenses:

Start by focusing on limiting your necessary spending to 50% of your monthly net income. This means trimming expenses where possible to avoid overspending, such as reducing the frequency of eating out or finding a comfortable house that suits your budget. These decisions might not be the most enjoyable, but they offer the most significant long-term benefit by freeing up funds for savings.

Follow the 30% Discretionary Spending Rule:

The discretionary spending category is where you have the most flexibility to enjoy life’s pleasures while staying within budget. Consider your hobbies and passions, as well as occasional indulgences, and allocate your 30% wisely. You don’t have to miss out on everything you enjoy, but spend wisely and stay within your limits to ensure you’re not overspending.

Save and Invest:

Finally, don’t forget about the savings and investment category. Committing 20% of your monthly net income towards savings and investment is essential for achieving financial freedom. Ensure you have adequate emergency savings before you start investing and consider investing in stocks, bonds, and other investment opportunities to grow your money over time.

Benefits of the 50/30/20 Rule

Following the 50/30/20 rule provides numerous benefits to your financial well-being, including:

Financial Discipline:

Adhering to a budgeting guideline like the 50/30/20 rule requires discipline. Consistently following the rule’s guidance on essential expenses, discretionary spending, and savings motivates you to live frugally beyond just a short-term emergency fund level.

Long-Term Security and Stability:

Implementing the 50/30/20 rule ensures that you build financial stability over time. By allocating 20% of your budget to savings and investments, you’re setting aside resources for the future while taking care of your day-to-day essentials.

Flexibility:

The 50/30/20 rule’s balance of essential expenses, discretionary spending, and savings means you have discretion and flexibility in your spending and your savings. Without rigid constraints, you have more control over your life and avoid feeling too restricted.

Motivation for Success:

The 50/30/20 rule is great in helping you achieve your financial goals without becoming overly abstract. Because of its simplicity, you’re more likely to succeed and stay motivated to follow the rule.

Less Financial Stress:

Finally, following the 50/30/20 rule can help reduce financial stress by providing a clear path to financial security. This sense of stability can transform your relationship with financial management, take weight off your shoulders and mind, and give you greater peace of mind.

Conclusion

Adhering to the 50/30/20 rule undoubtedly can bring financial freedom to your life. By budgeting for essential expenses, discretionary spending, and savings and investment, you can establish long-term financial security, reduce financial stress, and have more flexibility in your life. Follow your budget and ensure a balanced allocation of your income to emerge smarter, more frugal, and more prosperous. As you progress on your financial journey and your situation changes, you can always adjust your budget to fit your new circumstances. Start implementing the 50/30/20 rule and unlock your financial freedom.